Related Party Transactions Policy

1. Preamble:

The Companies Act, 2013 and the Rules made thereunder (“Said Act”) and Regulation 23 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 contains provisions related to Related Party Transactions and framing a policy on these transactions. In order to comply with the said Act, the Company has formulated this ‘Policy on Related Party Transactions’. The said policy includes materiality thresholds and manner of dealing with Related Party Transactions in compliance with the requirements of the Act and Regulation 23 of the SEBI Listing Regulations and amendments made thereto from time to time.

2. Scope:

This policy shall be applied in:

i.Identifying Related Parties, updating and maintaining the database of such Related Parties;

ii.Identifying Related Party Transactions;

iii.Identifying whether the Related Party Transactions are in the Ordinary Course of Business and at Arms’ Length in relation to the Related Parties;

iv.Obtaining approval before entering into the Related Party transactions;

v.Documenting the Arms’ Length pricing of transactions and

vi.Determining the disclosures to be made about these transactions.

3.Definitions

(a)“Act”: means the Companies Act, 2013 and the Rules framed thereunder including any modifications, amendments, clarifications, circulars or re-enactments thereof from time to time.

(b)“Audit Committee or Committee” shall have the same meaning as defined under Section 177 of the Companies Act, 2013 and Regulation 23 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

(c)“Arms Length Transactions” shall mean the transactions carried out between the Related Parties as if they are not related to each other avoiding the ‘Conflict of Interest’. The transactions carried on between the Company and the Related Party on similar terms and conditions as of unrelated party, including the price, and such price charged for the transactions to a Related Party has in no case been influenced by the relationship. For determining Arm’s Length basis, guidance may be taken from the transfer pricing provisions under the Income Tax Act, 1961.

(d) “Board” means Board of Directors of the Company

(e)“Company” means Unichem Laboratories Limited

(f)“Control” shall have the same meaning as defined under the Companies Act, 2013 and SEBI (Substantial Acquisition of Shares and Takeovers) Regulations 2011, in the context as may be mentioned as amended from time to time.

(g)“Key Managerial Personnel “means Key Managerial Personnel as defined under the Companies Act, 2013.

(h)“Material Related Party Transaction” means a Related Party Transaction which individually or taken together with the previous transactions during a financial year exceeds 10% of the annual consolidated turnover of the Company as per audited financial statements of the Company or such as may be prescribed under Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as may be amended from time to time.

Notwithstanding the above, a transaction involving payments made to a Related Party with respect to brand usage or to Royalty shall be considered material if the transaction(s) to be entered into individually or taken together with previous transactions during a financial year, exceed two percent of the annual consolidated turnover of the Company as per the last audited financial statements of the Company.

(i)“Ordinary Course of Business” shall mean and include

a.the usual transactions, customs and practices carried on generally in the pharmaceutical and health related industry and also by the Company as well, however it shall not include the following transactions:

(i) Complex equity transactions such as corporate restructuring or acquisitions, merger de-merger and amalgamation;

(ii)Transactions which may have material impact on the Company and

(iii)Such transactions as may be considered by the Audit Committee/Board not to be in ordinary course of business.

(j)“Policy” means the current Policy on Related Party Transaction, including amendments, if any from time to time.

(k)“Related Party” means a related party as defined under the Act read with Regulation 23 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 and as amended from time to time.

(l)“Related Party Transaction” means any transaction as defined under the Act, Rules made thereunder the Act and Regulation 23 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 from time to time.

(m)“Relative” means a relative as defined under the Act.

(n) “Transaction” with a Related Party shall be construed to include single transaction or a group of transactions in a contract.

All other words and expressions used but not defined in this Policy but defined in the Act, SEBI (Substantial Acquisition of Shares and Takeovers) Regulations 2011, SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 or the rules and regulations made thereunder shall have the same meaning as respectively assigned to them in such Act or rules and regulations or any statutory modification or re-enactment thereto, as the case may be.

4) Identification of Related Parties:

Each Director and Key Managerial Personnel is responsible for providing notice to the Audit/Board Committee of any potential Related Party Transaction involving him or her or his or her Relative, including any additional information about the Transaction that the Board/Audit committee may reasonably request. The Board/Audit Committee will determine whether the Transaction does in fact, constitute a Related Party Transaction requiring compliance with the Policy.

Every Director, Key Managerial Personnel and connected Related Parties shall at the beginning of the financial year disclose to the Company Secretary of the Company their Related Parties and disclose any changes thereto during the financial year as immediately as practicable.

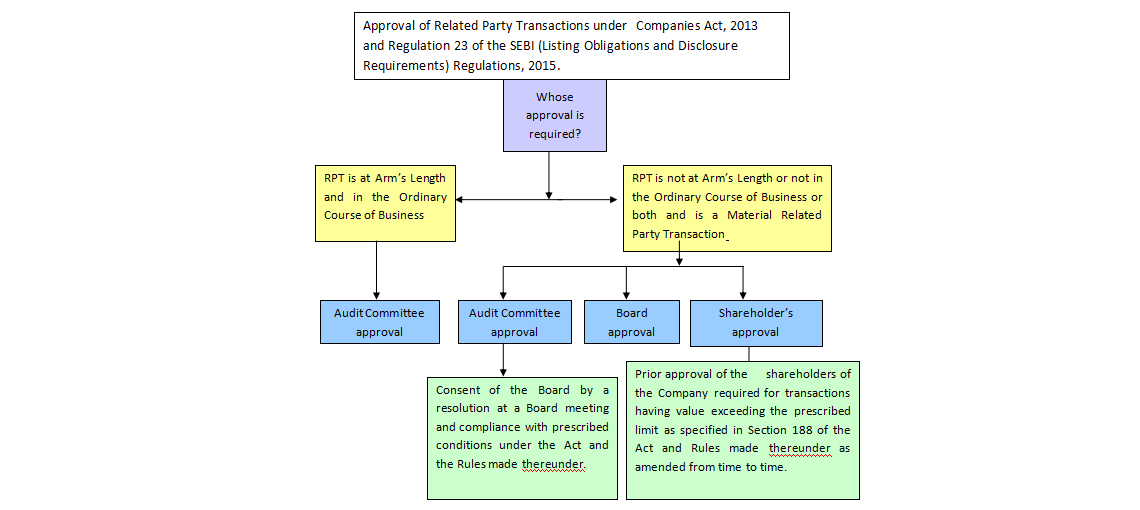

5) Approvals required for Related Party Transaction (RPT):

All Material Related Party Transactions shall require prior approval of the Shareholders and the Related Parties shall abstain from voting on such resolutions whether the entity is a related party to the particular transaction or not.

All Material Related Party Transactions shall require approval of the Shareholders through resolution. All entities falling under the definition of Related Parties shall abstain from Voting irrespective of whether the entity is a party to the transaction or not.

All Transactions, other than Material Related Party Transactions, with Related Parties which are not on Arm’s length basis and not in Ordinary Course of Business and which exceed the specified threshold limit prescribed under Section 188 of the Act and the Rules made thereunder from time to time, shall be made only with prior approval of the shareholders and the Related Party/ies with whom the transaction is to be entered into shall abstain from voting on such resolutions whether the entity is a Related Party to the particular transaction or not.

In the event the Company becomes aware of a Related Party Transaction that has not been approved or ratified under this Policy, the Transaction shall be placed as promptly as practicable before the Committee or board or the Shareholders as the case may be required in accordance with this Policy for review and ratification.

The Audit Committee or the Board or the Shareholders as the case may be shall consider all relevant facts and circumstances respecting such Transaction and shall evaluate all options available to the Company, including but not limited to ratification, revision or termination of such Transaction(s) and the Company shall take such action as the Committee deems appropriate under the circumstances.

6) Review of Related Party Transactions by the Audit Committee and the Board

Related Party Transaction with a Related Party shall be referred to the Audit Committee for its review and approval.

i.To review a Related Party Transaction, the Audit Committee will be provided with all relevant material information of the Related Party Transaction, including the terms of the transaction, the business purpose of the Transaction, the benefits to the Company and to the Related Party, and any other relevant matters.

ii.In determining whether to approve a Related Party Transaction, the Committee will consider the following factors, among others, to the extent relevant to the Related Party Transaction:

a.Whether the terms of the Related Party Transaction are fair and on arms length basis to the Company and in Ordinary Course of Business and would apply on the same basis if the transaction did not involve a Related Party?

b.Whether there are any compelling business reasons/rationale for the Company to enter into the Related Party Transaction and the nature of alternative transactions, if any?

c.Whether the Related Party Transaction would affect the independence of an Independent Director?

d.Whether the proposed transaction includes any potential risk issues that may arise as a result of or in connection with the proposed transaction?

e.Whether the Company was notified about the Related Party Transaction before its commencement and if not, why pre- approval was not sought and whether subsequent ratification is allowed and would be detrimental to the Company; and

f.Whether the Related Party Transaction would present conflict of interest for any director or Key Managerial Personnel of the Company, taking into account the size of the transaction, the overall financial position of the director, Key Managerial Personnel or other Related Party, the direct or indirect nature of the director’s, Key Managerial Personnel’s or other Related Party’s interest in the transaction and the ongoing nature of any proposed relationship and any other factors the Board/Audit Committee deems relevant?.

If the Audit Committee determines that a Related Party Transaction should be brought before the Board, or if the Board in any case elects to review any such matter or it is mandatory under any law for Board to approve the Related Party Transaction, then the considerations set forth above shall apply to the Board’s review and approval of the matter, with such modification as may be necessary or appropriate under the circumstances.

7) Omnibus Approval for Related Party transactions

The Audit Committee may grant prior approval for Related Party Transactions, in compliance of conditions contained in Regulation 23 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 , the Companies Act, 2013 and the Rules made thereunder.

8) Exemptions

Nothing contained in this Policy shall apply to any contract or arrangements with Related Party—

i.In the Ordinary Course of its business and on an Arms’ length basis;

ii. Any transaction that involves the providing of compensation to a director or Key Managerial Personnel in connection with his or her duties to the Company or any of its Subsidiaries or associates, (as defined under the Act) including the reimbursement of reasonable business and travel expenses incurred in the Ordinary Course of Business;

iii.Any transaction in which the Related Party’s interest arises solely from ownership of securities issued by the Company and all holders of such securities receive the same benefits pro rata as the Related Party;

iv.Transactions available to all employees generally ;

v.Service availed in a professional capacity from body corporate/person;

vi.The following transaction(s) undertaken by the Independent Director with the Company or its holding, subsidiary, or associate company or their promoters or directors during the year:

(a)transaction(s) done in Ordinary Course of Business at arm’s length;

(b) receipt of remuneration by way of sitting fees;

(c) reimbursement of expenses for attending board and other meetings;

(d) any profit related commission as approved by members.

9) Disclosures

Details of any Related Party Transaction shall be disclosed to the Stock Exchanges as per the provisions of Regulation 23 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

The Company shall disclose the Policy on its website and web-link shall be provided in the Annual Report.

10) Indemnity

Where any contract or arrangement is entered into by a director or any other employee, without obtaining the consent of the Audit Committee/ Board or approval by a Special Resolution in the General Meeting under Sub Section (1) of Section 188 of the Companies Act, 2013 and if it is not ratified by the Board or, as the case may be, by the shareholders at a meeting within three months from the date on which such contract or arrangement was entered into, such contract or arrangement shall be voidable at the option of the Board /Shareholders, as the case may be, and if the contract or arrangement is with a Related Party to any director, or is authorized by any other director, the director(s) concerned shall indemnify the Company against any loss incurred by it.

11) Penalties

The Audit Committee /Board may proceed against the Director / Key Managerial Personnel, who had entered into contract or arrangement in contravention of the provisions, for recovery of any loss sustained by result of such contract or arrangement in such manner, it may deem fit and proper.

12) Scope Limitation

In the event of any conflict between the provision of this Policy and of the Listing Agreement/Companies Act, 2013 or any other statutory enactments, rules, the provisions of such Listing Agreement/Companies Act, 2013, or statutory enactments, rules shall prevail over this Policy.

This policy shall be amended in accordance with the amendments made vide notifications / circulars as may be published in Official Gazette of India from time to time.

13)Review of Policy

This policy (including the thresholds) shall be reviewed by the Board of Directors at least once every three years and updated accordingly.

This policy has been amended, approved and adopted by the Board of Directors at their meeting held on February 1, 2019.